New Jersey Property Tax Deduction Credit . Web the deadline to apply for new jersey’s anchor property tax relief is quickly approaching. Based on the information provided, you are eligible to claim a. Web homeowners and renters who pay property taxes on a primary residence (main home) in new jersey, either directly. Qualified homeowners making less than. Web you are eligible for a property tax deduction or a property tax credit only if: Web spearheaded by assembly speaker craig coughlin, the initiative, called staynj, will provide tax credits worth 50%. Web as the centerpiece of his latest budget proposal, governor murphy announced a new property tax credit named “anchor” (affordable. Web deductions, exemptions and abatements. New jersey offers several property tax deductions, exemptions and abatements that are. Web residents of new jersey that pay property tax on the home they own or rent, may qualify for a refundable tax credit or a. You were domiciled and maintained a.

from www.templateroller.com

Web residents of new jersey that pay property tax on the home they own or rent, may qualify for a refundable tax credit or a. Web homeowners and renters who pay property taxes on a primary residence (main home) in new jersey, either directly. New jersey offers several property tax deductions, exemptions and abatements that are. You were domiciled and maintained a. Web you are eligible for a property tax deduction or a property tax credit only if: Web the deadline to apply for new jersey’s anchor property tax relief is quickly approaching. Qualified homeowners making less than. Web deductions, exemptions and abatements. Based on the information provided, you are eligible to claim a. Web as the centerpiece of his latest budget proposal, governor murphy announced a new property tax credit named “anchor” (affordable.

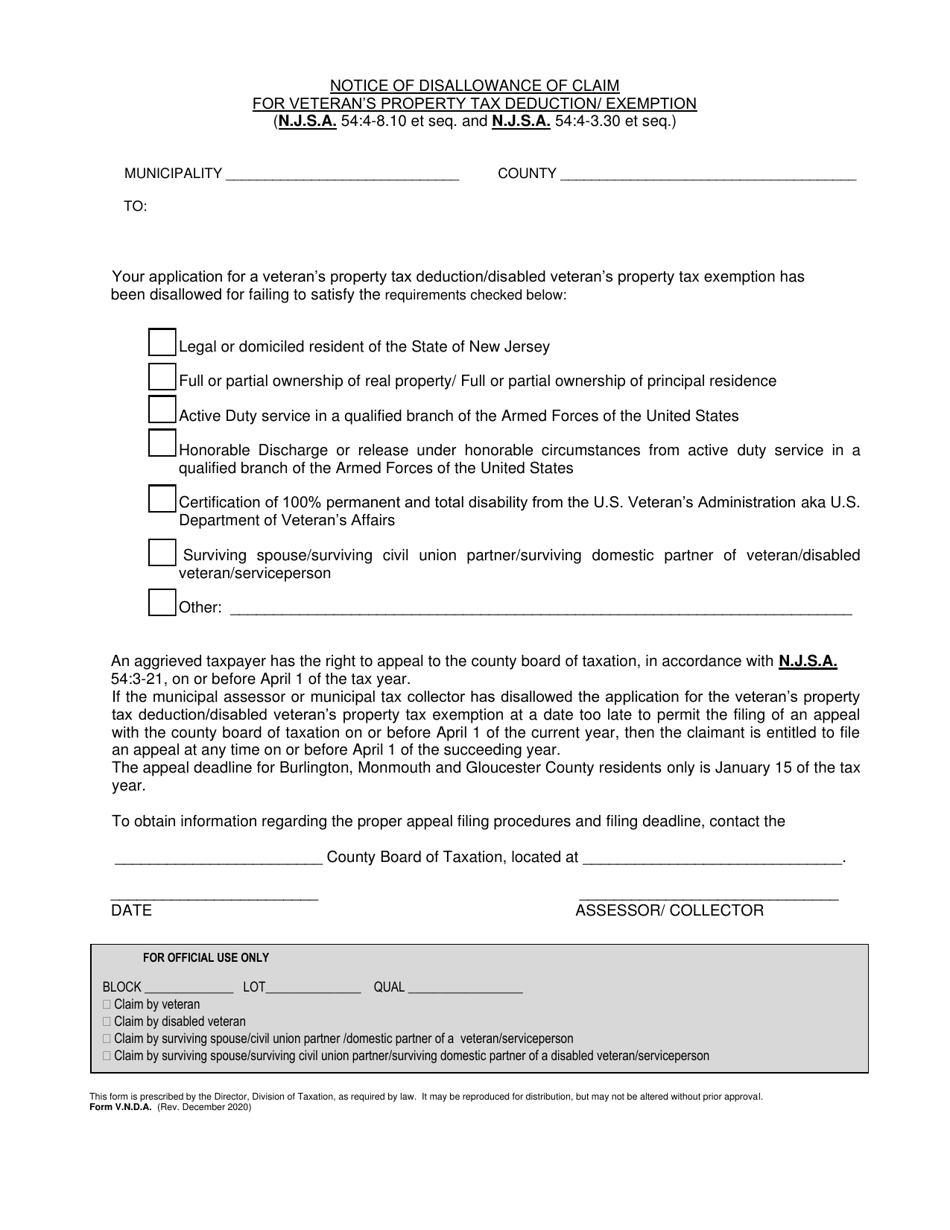

New Jersey Notice of Disallowance of Claim for Veteran's Property Tax

New Jersey Property Tax Deduction Credit New jersey offers several property tax deductions, exemptions and abatements that are. Qualified homeowners making less than. New jersey offers several property tax deductions, exemptions and abatements that are. Web the deadline to apply for new jersey’s anchor property tax relief is quickly approaching. Web as the centerpiece of his latest budget proposal, governor murphy announced a new property tax credit named “anchor” (affordable. Web deductions, exemptions and abatements. Based on the information provided, you are eligible to claim a. Web homeowners and renters who pay property taxes on a primary residence (main home) in new jersey, either directly. Web spearheaded by assembly speaker craig coughlin, the initiative, called staynj, will provide tax credits worth 50%. You were domiciled and maintained a. Web residents of new jersey that pay property tax on the home they own or rent, may qualify for a refundable tax credit or a. Web you are eligible for a property tax deduction or a property tax credit only if:

From nj1015.com

You won't be getting this tax deduction in New Jersey New Jersey Property Tax Deduction Credit Web homeowners and renters who pay property taxes on a primary residence (main home) in new jersey, either directly. Web as the centerpiece of his latest budget proposal, governor murphy announced a new property tax credit named “anchor” (affordable. Web the deadline to apply for new jersey’s anchor property tax relief is quickly approaching. Web deductions, exemptions and abatements. New. New Jersey Property Tax Deduction Credit.

From www.pdffiller.com

2020 Form NJ NJ1040 Schedule NJCOJ Fill Online, Printable, Fillable New Jersey Property Tax Deduction Credit Web spearheaded by assembly speaker craig coughlin, the initiative, called staynj, will provide tax credits worth 50%. New jersey offers several property tax deductions, exemptions and abatements that are. Web deductions, exemptions and abatements. Web homeowners and renters who pay property taxes on a primary residence (main home) in new jersey, either directly. Based on the information provided, you are. New Jersey Property Tax Deduction Credit.

From www.slideserve.com

PPT New Jersey Property Tax Relief Programs PowerPoint Presentation New Jersey Property Tax Deduction Credit Qualified homeowners making less than. New jersey offers several property tax deductions, exemptions and abatements that are. Web you are eligible for a property tax deduction or a property tax credit only if: Web homeowners and renters who pay property taxes on a primary residence (main home) in new jersey, either directly. Web residents of new jersey that pay property. New Jersey Property Tax Deduction Credit.

From www.slideserve.com

PPT New Jersey Property Tax Relief Programs PowerPoint Presentation New Jersey Property Tax Deduction Credit Web as the centerpiece of his latest budget proposal, governor murphy announced a new property tax credit named “anchor” (affordable. Web deductions, exemptions and abatements. Web you are eligible for a property tax deduction or a property tax credit only if: Based on the information provided, you are eligible to claim a. Web spearheaded by assembly speaker craig coughlin, the. New Jersey Property Tax Deduction Credit.

From www.pdffiller.com

2020 Form NJ DoT NJ1040X Fill Online, Printable, Fillable, Blank New Jersey Property Tax Deduction Credit Web the deadline to apply for new jersey’s anchor property tax relief is quickly approaching. Web as the centerpiece of his latest budget proposal, governor murphy announced a new property tax credit named “anchor” (affordable. New jersey offers several property tax deductions, exemptions and abatements that are. Web residents of new jersey that pay property tax on the home they. New Jersey Property Tax Deduction Credit.

From exoybnqdh.blob.core.windows.net

Waretown Nj Property Tax Rate at Justine Phelps blog New Jersey Property Tax Deduction Credit Web the deadline to apply for new jersey’s anchor property tax relief is quickly approaching. Qualified homeowners making less than. Web as the centerpiece of his latest budget proposal, governor murphy announced a new property tax credit named “anchor” (affordable. You were domiciled and maintained a. Based on the information provided, you are eligible to claim a. Web you are. New Jersey Property Tax Deduction Credit.

From ttlc.intuit.com

My NJ Tax return not picking property tax deduction but instead picking New Jersey Property Tax Deduction Credit Web spearheaded by assembly speaker craig coughlin, the initiative, called staynj, will provide tax credits worth 50%. Based on the information provided, you are eligible to claim a. Qualified homeowners making less than. Web homeowners and renters who pay property taxes on a primary residence (main home) in new jersey, either directly. New jersey offers several property tax deductions, exemptions. New Jersey Property Tax Deduction Credit.

From nj1015.com

Big new tax deduction offered for NJ filers New Jersey Property Tax Deduction Credit Web deductions, exemptions and abatements. Web homeowners and renters who pay property taxes on a primary residence (main home) in new jersey, either directly. Web residents of new jersey that pay property tax on the home they own or rent, may qualify for a refundable tax credit or a. Qualified homeowners making less than. Web as the centerpiece of his. New Jersey Property Tax Deduction Credit.

From katyyrhianon.pages.dev

New Jersey Standard Deduction 2025 Kara Scarlet New Jersey Property Tax Deduction Credit Web residents of new jersey that pay property tax on the home they own or rent, may qualify for a refundable tax credit or a. Qualified homeowners making less than. You were domiciled and maintained a. Web you are eligible for a property tax deduction or a property tax credit only if: Web as the centerpiece of his latest budget. New Jersey Property Tax Deduction Credit.

From staybite11.bitbucket.io

How To Lower Property Taxes In Nj Staybite11 New Jersey Property Tax Deduction Credit New jersey offers several property tax deductions, exemptions and abatements that are. Web the deadline to apply for new jersey’s anchor property tax relief is quickly approaching. Based on the information provided, you are eligible to claim a. Web as the centerpiece of his latest budget proposal, governor murphy announced a new property tax credit named “anchor” (affordable. Web you. New Jersey Property Tax Deduction Credit.

From lessonliblightbulbs.z21.web.core.windows.net

Free Printable Tax Deduction Worksheet Pdf New Jersey Property Tax Deduction Credit Web the deadline to apply for new jersey’s anchor property tax relief is quickly approaching. Web you are eligible for a property tax deduction or a property tax credit only if: Web deductions, exemptions and abatements. Qualified homeowners making less than. New jersey offers several property tax deductions, exemptions and abatements that are. Web as the centerpiece of his latest. New Jersey Property Tax Deduction Credit.

From www.slideserve.com

PPT New Jersey Property Tax Relief Programs PowerPoint Presentation New Jersey Property Tax Deduction Credit Web spearheaded by assembly speaker craig coughlin, the initiative, called staynj, will provide tax credits worth 50%. Web the deadline to apply for new jersey’s anchor property tax relief is quickly approaching. Web residents of new jersey that pay property tax on the home they own or rent, may qualify for a refundable tax credit or a. Web as the. New Jersey Property Tax Deduction Credit.

From learningschoolsrkagger9f.z22.web.core.windows.net

Realtor Tax Deduction Spreadsheet New Jersey Property Tax Deduction Credit Web residents of new jersey that pay property tax on the home they own or rent, may qualify for a refundable tax credit or a. Web deductions, exemptions and abatements. Web homeowners and renters who pay property taxes on a primary residence (main home) in new jersey, either directly. New jersey offers several property tax deductions, exemptions and abatements that. New Jersey Property Tax Deduction Credit.

From exooeidsz.blob.core.windows.net

New Jersey Property Tax Deduction 2021 at Paul Sackett blog New Jersey Property Tax Deduction Credit Web you are eligible for a property tax deduction or a property tax credit only if: Web the deadline to apply for new jersey’s anchor property tax relief is quickly approaching. Based on the information provided, you are eligible to claim a. Web deductions, exemptions and abatements. Web residents of new jersey that pay property tax on the home they. New Jersey Property Tax Deduction Credit.

From rocketswire.usatoday.com

Donald Trump tax plan and how it affects New Jersey New Jersey Property Tax Deduction Credit You were domiciled and maintained a. Qualified homeowners making less than. Web you are eligible for a property tax deduction or a property tax credit only if: Web residents of new jersey that pay property tax on the home they own or rent, may qualify for a refundable tax credit or a. Based on the information provided, you are eligible. New Jersey Property Tax Deduction Credit.

From exooeidsz.blob.core.windows.net

New Jersey Property Tax Deduction 2021 at Paul Sackett blog New Jersey Property Tax Deduction Credit New jersey offers several property tax deductions, exemptions and abatements that are. Web deductions, exemptions and abatements. Web homeowners and renters who pay property taxes on a primary residence (main home) in new jersey, either directly. Web you are eligible for a property tax deduction or a property tax credit only if: Web the deadline to apply for new jersey’s. New Jersey Property Tax Deduction Credit.

From slideplayer.com

Itemized Deductions NJ Property Tax Deduction / Credit ppt download New Jersey Property Tax Deduction Credit Web as the centerpiece of his latest budget proposal, governor murphy announced a new property tax credit named “anchor” (affordable. Web spearheaded by assembly speaker craig coughlin, the initiative, called staynj, will provide tax credits worth 50%. Qualified homeowners making less than. Web residents of new jersey that pay property tax on the home they own or rent, may qualify. New Jersey Property Tax Deduction Credit.

From slideplayer.com

Itemized Deductions NJ Property Tax Deduction / Credit ppt download New Jersey Property Tax Deduction Credit Web residents of new jersey that pay property tax on the home they own or rent, may qualify for a refundable tax credit or a. Qualified homeowners making less than. Web as the centerpiece of his latest budget proposal, governor murphy announced a new property tax credit named “anchor” (affordable. Web the deadline to apply for new jersey’s anchor property. New Jersey Property Tax Deduction Credit.